What Are the Rules/Habits of Old Money

Ask ten people to define “old money” and you will hear ten versions: inherited wealth, country estates, blazers with crested buttons, trust funds.

Strip away the stereotypes and you find something more useful—disciplined habits that help wealth last when most fortunes fade. Research on multi-generational families shows that money disappears fast when spending outruns values, when heirs feel entitled, and when the family never learns to talk about finances honestly.

Consultants who work with affluent families warn that “loud” signals can backfire in a world sensitive to inequality; discretion and quality tend to win. These insights sit behind the seven core old money habits we will dig into below.

Before we dive deep, here is the quick list many old-money families still live by:

-

Live below your means.

-

Invest in quality (buy well, buy once).

-

Develop multiple income streams.

-

Plan for the long term.

-

Diversify your investments.

-

Practice stealth wealth (quiet signals beat loud logos).

-

Embrace a legacy mindset: educate heirs, give back, preserve values.

We will unpack each rule in plain language, show how you can apply it even without a trust fund, and connect wardrobe choices along the way. To help you build the visual side of the lifestyle, you will find three relevant collections from RealOldMoney.com—linked once each, exactly as requested:

Let’s get started.

1. Live Below Your Means

The rule: Spend less than you earn, even if you earn a lot. Old-money households often look less flashy than their bank balances suggest.

A family may own land, art, and diversified portfolios, yet drive a five-year-old SUV and patch sweaters. The savings gap funds investment, cushions downturns, and reduces the need to liquidate core assets during bad markets.

How to apply (any income level):

-

Track annual burn—not monthly fragments. Wealthy families often review a full-year budget at once to see lifestyle creep.

-

Automate transfers. Pay investments like a bill; money you never see is money you never overspend.

-

Cap lifestyle raises. When income jumps, move only a fraction into spending; direct the rest to long-term assets.

Wardrobe angle: Instead of buying five cheap shirts that fade, invest in one proper Oxford that lasts years. See the range in Old-Money Shirts for examples of fabrics that reward repeat wear.

Why it matters: Advisors who work with multi-generation families warn that unchecked spending breeds entitlement in children and strains future inheritances; keeping expectations grounded helps fortunes survive transitions.

2. Invest in Quality

The rule: Buy the best you can afford in things you use often—coats, shoes, tools, education. Old-money families think in cost-per-use, not sticker shock. Over time, premium goods that repair well cost less than disposable versions.

How to apply:

-

Use the “100 wears” test. If you will wear an item 100 times, paying more for better cloth and stitching usually pays off.

-

Favor natural fibers: wool, cotton, linen, cashmere. They can be mended and often age attractively.

-

Document repairs. Tracking resoles and re-linings helps you see value and plan upkeep.

Wardrobe angle: A well-cut pair of mid-grey trousers will anchor suits, blazers, and weekend knits. Start a quality rotation in Old-Money Pants—neutral colors stretch the wardrobe.

Why it matters: Fashion observers covering Milan’s “quiet luxury” seasons point out that the movement centers on material integrity and expert tailoring you appreciate up close, not giant logos you see across the room. Investing in fewer, better pieces is the defining style signal for those who prefer discretion over display. (The Guardian)

3. Develop Multiple Income Streams

The rule: Old-money families rarely rely on a single paycheck. Income may flow from dividends, rental property, timber rights, royalties, or minority stakes in businesses. Diverse cash flow spreads risk and funds charitable or family goals without touching principal.

How to apply without a fortune:

-

Build a side skill that earns even a few hundred a month; funnels straight into investments.

-

Use tax-advantaged accounts where available; compounding turns small side income into capital.

-

Consider fractional ownership (index funds, real-estate investment trusts) if large assets are out of reach.

Wardrobe angle: Accessories can become micro-income. Some families turn heirloom cuff links, vintage ties, or estate belt buckles into rental or resale micro-businesses. Explore finishing touches in Old-Money Accessories if you plan to build a collection that could later be traded or loaned.

Why it matters: Family wealth advisers caution that when heirs believe lifestyle depends on a single business, conflict rises. Teaching kids that wealth comes from multiple working sources builds resilience and reduces entitlement pressure tied to one “golden goose.”

4. Plan for the Long Term

The rule: Old money thinks in decades. Estates budget for roof replacements years ahead, schedule trust distributions by age bands, and map philanthropy over generations. This time horizon prevents emotional selling and impulsive lifestyle swings.

Starter steps:

-

Set 10-, 20-, and 50-year family goals: education funds, land conservation, charitable endowments.

-

Use written policies. Even a simple two-page family spending charter (“We save X percent; gifts above Y require consensus”) sets expectations.

-

Revisit annually; calendar a “family finance day” each year.

Why it matters: Experts who coach wealthy parents stress that clarity about money over time is one of the strongest antidotes to the entitlement trap. When young family members see the purpose of assets—tuition, community projects, future security—they manage spending with more care and less secrecy.

5. Diversify Your Investments

The rule: Do not bet the family on one asset class. Traditional old-money portfolios mix public equities, high-grade bonds, real assets (land, timber, art), and operating businesses. The blend shifts, but the principle stays: protect against shocks.

Action ideas:

-

Start with broad index funds if new to investing; low cost, instant spread.

-

Add inflation hedges—real estate investment trusts, farmland funds, or TIPS depending on region.

-

Keep a liquidity sleeve (cash or short-term notes) so you never sell long-term holdings under stress.

-

Educate heirs about correlation. Use a simple chart to show how different assets move.

Why it matters: Family business advisers interviewed by Harvard Business Review note that concentrated positions tied to the founding business magnify risk; diversification plus shared education lowers odds the next generation will panic or overspend if core income dips. (Harvard Business Review)

6. Practice Stealth Wealth

The rule: Understated beats flashy. In eras of stark inequality, broadcasting status can appear tone-deaf. Old money signals quality through fit, fabric, and ease—not giant logos.

How to apply:

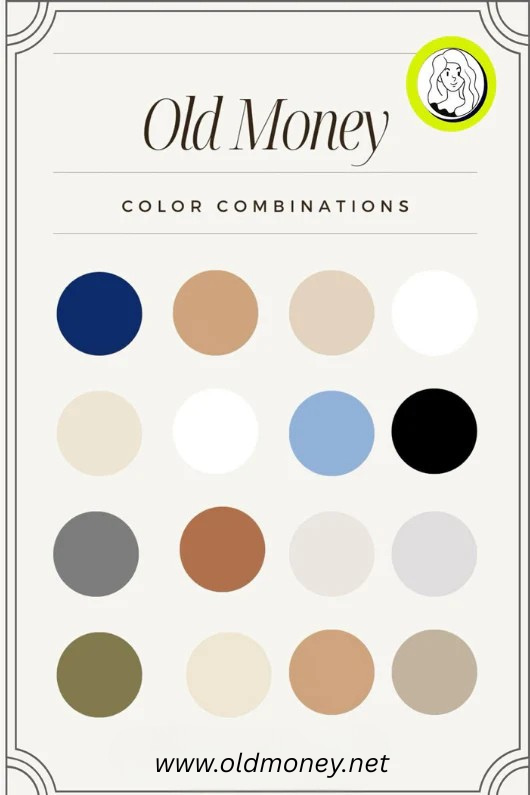

-

Neutral palette: navy, camel, stone, soft grey.

-

Fine tailoring: soft shoulders, proper alterations.

-

Subtle details: mother-of-pearl buttons, hand-rolled edges, invisible branding.

-

Repeat outfits. Wearing the same high-quality blazer weekly signals confidence, not scarcity.

Evidence from fashion: Coverage of Milan Fashion Week highlighted how designers leaned away from logo-mania toward refined cuts, muted palettes, and luxurious fabrics—an approach trend forecasters tie directly to the cultural pull of “quiet luxury” and the Succession effect. Observers link the shift to wealthy clients seeking discretion amid broader societal scrutiny of excess.

7. Embrace a Legacy Mindset

The rule: Money lasts when values last. Old-money families invest time teaching kids about work, gratitude, philanthropy, and privacy. They discuss what wealth is for—not just what it buys. They also create structures (trusts, foundations, family councils) that keep relatives talking when stakes are high.

Practical moves:

-

Age-graded transparency: share allowance basics with kids, charitable giving details with teens, balance-sheet outlines with adult heirs.

-

Involve the next generation in giving. Let each child propose a small annual donation and present why.

-

Rotate meeting leadership. Young adults chair once a year to learn stewardship.

-

Capture stories—record grandparents on video discussing frugality and risk.

Why it matters: Harvard Business Review authors warn that wealthy parents fear raising entitled children for good reason; studies cited in their work show most fortunes deteriorate within a few generations when heirs are not prepared for responsibility. Active conversations, shared decision rules, and exposure to real costs help prevent that slide.

Bringing the Rules Into Daily Life

Below is a simple action ladder that translates the seven habits into weekly and yearly routines. Print, post on the fridge, or adapt for a family meeting.

Weekly

-

Track discretionary spend (coffee, dining, streaming) to reinforce “below means.”

-

Repair one thing before buying another (button, shoe polish).

-

Rotate quality wardrobe pieces so cost-per-wear stays low.

Monthly

-

Transfer side-income to investment account.

-

Review asset mix briefly: are contributions going only into company stock? Adjust.

-

Discuss one family value story at dinner—why granddad saved, how grandma funded college.

Quarterly

-

Examine clothing and gear for repair vs replace.

-

Update written goals: education savings progress, charitable pledges funded, travel budget.

-

Hold a 1-hour “family finance call” if spread across cities.

Yearly

-

Rebalance portfolio to target ranges.

-

Review estate documents; confirm beneficiaries.

-

Evaluate big purchases using a 5-year outlook (car, renovation).

-

Audit wardrobe vs needs; donate excess; invest in one “quality upgrade” guided by the rules above.

Old-Money Style Cliff Notes (Fast Reference)

|

Habit |

Everyday Money Move |

Style Translation |

Why It Signals Old Money |

|

Live below means |

20% auto-invest |

Repeat outfits |

Shows priorities beyond display |

|

Invest in quality |

Buy repairable goods |

Solid oxford, welted shoe |

Patina > price tags |

|

Multiple incomes |

Side gig to ETF |

Mix high/low pieces |

Resilience over flash |

|

Long-term plan |

10-year spend map |

Keep classic coat 10+ yrs |

Continuity |

|

Diversify |

Broad asset mix |

Seasonal wardrobe rotation |

Adaptability |

|

Stealth wealth |

Neutral palette |

No giant logos |

Discretion = security |

|

Legacy |

Family meetings |

Heirloom cuff links passed down |

Story outlives stuff |

Frequently Asked Questions

Do I need to be rich to follow old money habits?

No. The rules are scalable. A student thrift-shopping and sewing buttons is practicing the same discipline a family office applies with art collections.

Is stealth wealth just about clothes?

Clothes are shorthand. The deeper move is spending in line with values and privacy. Quality over quantity.

How do I start family money talks without making it awkward?

Begin with goals (“What do we want money to do for us?”) and small disclosures (holiday budget) before sharing full numbers. Gradual transparency lowers entitlement and shock.

Conclusion: Wealth That Lasts Looks Boring Day to Day—and Brilliant Over Time

Old money is not magic. It is the steady practice of earning, preserving, teaching, and editing. Live beneath your income, choose quality, build more than one income stream, plan decades ahead, diversify, stay discreet, and pass on both stories and spreadsheets. Apply these habits and your financial life starts to look resilient, even if you are beginning from zero.

If you want the visual shorthand that supports the mindset, start small:

-

Upgrade a staple shirt in breathable cotton from Old-Money Shirts.

-

Add a neutral, well-cut trouser from Old-Money Pants that works across seasons.

-

Finish with a subtle belt or heirloom-worthy watch strap from Old-Money Accessories to remind you that details matter.

Money comes and goes. Habits stay. Build the habits and you build something your heirs can inherit with pride.